The Ultimate Guide to Designing Custom Business Checks

Business checks are an essential tool for businesses that want to present a positive image to their clients and customers. They also help to keep track of expenditures and prevent fraud by implementing security features such as watermarks and warning bands.

Fortunately, business owners can design their checks online with the right software solutions. This helps to save time and effort while providing a better company image.

Designing a Check Template

If you are a business owner, chances are you frequently use checks to make payments. A check template is a great way to ensure your checks are correct and contain all the necessary information. It will also help you save time and money by eliminating the need for handwritten checks. In addition, it will give your company a professional image. You can download a free blank check template online or create one from scratch. You can also add a logo and other graphics to your template.

Creating your check template is easy. You can start by adding a background image or a photo of yourself to the top left corner. You can then add your company name and address below it. Next, you need to enter the bank account number. Be sure to use the correct format (routing number followed by an account number). Finally, you can enter the amount you want to pay.

Once you have completed the basic information, you can click on "Preview" to see how your check will look when it is printed. The preview will be roughly the size of a real business check, so you can make adjustments as needed. Once you are satisfied with the look of your check, you can save it as a file.

When you are ready to print your check, remember that you must always use a high-quality opaque envelope to protect the contents from prying eyes. You should also sign the check-in in blue or black ink and include a watermark or other security feature to prevent tampering. You should also keep copies of your signed checks in a safe place for future reference.

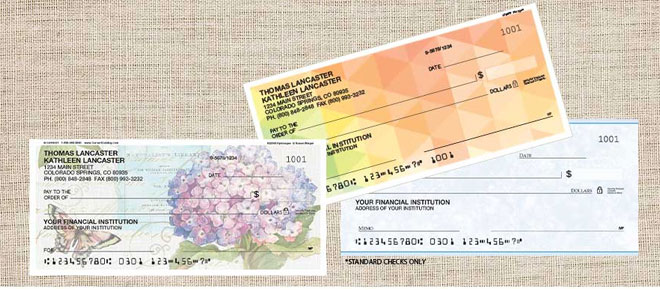

The most common types of business checks are personal, payroll, and corporate. Each type has its features and advantages. For example, a personal check includes spaces for your social security number and name, while a payroll check contains the employee's name and address. A corporate check is a legal document and contains the employer's company name, address, and tax ID number. It can also contain the company's logo and is usually written in a standard font.

Types of Checks

Businesses need to use checks to pay for products and services. Whether you need to pay your employees or cover operating expenses, business checks are a quick and convenient way to make a payment. While most companies now use credit cards or online money transfers, business checks remain a popular choice for many owners. They help create a professional image and offer extra security features to protect your finances.

When choosing the right type of business check for your company, consider factors such as the size, style, and color of the check. Also, you should look for a supplier that offers customization to further market your brand. Ultimately, you want your company's name to appear in front of every person who sees the check. A good way to ensure this is to choose a supplier that offers premium designs and logos.

You should also consider the type of software that you use to process your business's payments. Some suppliers offer custom business checks that are compatible with your accounting software. In this case, you should be able to customize the information that appears on the check, such as the amount, account number, and routing number. You can even include your company's logo in a watermark to further mark the document as a business check.

To customize your business check, you can use check printing software or an online check printing service at Online Services Coupon Code. These tools allow you to add your company logo, customize the check layout, and input necessary payment information. Just make sure to follow any guidelines or regulations set by your bank or financial institution to ensure the check is valid and accepted.

Some business checks also come with a separate pay stub and invoice section for bookkeeping purposes. These types of checks are more expensive than personal business checks, but they can help you manage your company's cash flow more efficiently. They can also be customized to include a company logo and several security features, such as fugitive ink and chemical wash detection boxes.

Finally, you should also think about the layout of your business checks. Some businesses prefer to have one check per page while others like three-to-a-page options. Regardless of what you decide, it is important to keep in mind that business checks should always appear professional. Including a logo on the checks will enhance your corporate image and make your business look more legitimate. It is also a great way to differentiate your business from other competitors and strengthen customer recognition.

Adding a Logo

Business checks are a crucial part of any company’s accounting system. As a result, they need to be carefully designed to ensure that they are readable and legally compliant. In addition, they should be aligned with the company’s brand image. Adding a logo to the check is an effective way to promote the brand and increase its visibility.

Adding a logo to a check is a simple process. First, you need to create a digital signature file that will be used to print your business checks. Then, you need to save this file in a location that is accessible to all users. You can save it in the same folder as your QuickBooks company file or in a different one.

After the signature file is saved, you can use it to print your checks. To do this, start by opening the company file and selecting the Signature and Stationery tab. Once you’ve selected this tab, click Edit Signature and enter your name and company in the fields provided. Then, select the Logo option in the drop-down menu and select your logo from the list of available files. Then, click OK to save your changes.

A logo on a check shows that your company is committed to its brand and values. It also makes your company look professional and reputable. As a result, customers are more likely to purchase from a brand that they trust.

The colors and fonts you use in your logo communicate the message you want to convey. For example, blue and white can imply reliability and trustworthiness. Similarly, black and white can evoke feelings of professionalism. In general, you should choose colors that are related to your company’s brand identity and complement each other.

If you want to add a logo to your business checks, you can use a software solution like PostGrid. This will allow you to design custom business checks that match your brand and are ready to mail in just a few clicks. In addition to creating customized checks, this tool can also help you print and track mailings and delivery times.

Adding a Signature

The signature is an essential part of a check, and it must be legible. In addition, it should match the person’s name as shown on their government-issued ID or bank account. If you’re printing multiple checks, make sure to leave a small space between each signature line so that they will all print correctly when imported into QuickBooks. You can also use a MICR laser printer to ensure that your signatures are printed clearly and will scan correctly when they are deposited into your bank account.

If you want to add a signature to your business checks, you can upload an image of the signature using the Payment Methods report. The file should be a JPEG and should be no more than 400 pixels wide by 260 pixels tall. The file will then be imported into your payments, and it will appear on your checks.

To add a signature to your checks, you must have a MICR laser printer. This is a type of printer that uses magnetic ink to read information on paper and creates a digital image of the signature. This type of printer is commonly used by banks and businesses that need to produce high-quality checks.

Check Advantage Promo Code is an easy-to-use online check printing platform that allows you to create custom checks for your business. It offers many features to help you streamline your check-writing process and customize your checks with your company logo and signature. You can also select a security option for your checks, including chemically sensitive paper and micro printing. You can even choose to include a warning box and TamperGuard Plus for enhanced security at an additional cost.

To get started with Check Advantage, simply log in to your account and go to the top menu “Settings->Check Setup.” You can then add your company logo to this page, and you can change the position of the logo to move it around on the check. Once you’ve finished, click UPDATE to save your changes.

Adding a signature to your business checks can help you improve security and reduce costs. However, it’s important to note that you must have a signed document that meets the legal requirements of the E-Signature Act and the Uniform Electronic Transactions Act to use an electronic signature on your checks. If you are unsure of the proper procedure, it is best to consult with a legal expert.

Conclusion

When choosing the right type of business check for your company, consider factors such as the size, style, and color of the check. Check Advantage is an easy-to-use online check printing platform that allows you to create custom checks for your business. It offers many features to help you streamline your check-writing process and customize your checks with your company logo and signature.